Expert consultants in financial crime compliance and business ethics and integrity

Lessons Learned is a consultancy whose unique approach gets your management and staff thinking about risks, making better decisions and applying the lessons of the past, enabling you to move forward responsibly to meet your strategic goals.

We work with multilateral institutions, private sector corporations and NGOs to help promote and embed best practice in financial crime compliance and business ethics and integrity through leadership, governance, policies and training.

Our Services

Bespoke Face to Face

How much are you doing in the classroom?

Used in the right way, e-learning can be a powerful tool in your organisation. It's great for introducing concepts, conveying detail, testing knowledge and of course, training masses of people...

...but sometimes, you've just got to get people in a room and talk to them...

E-Learning

Large organisations can’t really not do e-learning these days. The problem is that many staff lose the will to live with the standard nature of much of what is on offer.

At Lessons Learned, we create remote learning experiences that are guaranteed to make your staff sit up and think…

Consulting

Are you looking for a trusted partner to guide you through dangerous territory?

Perhaps you’ve had a poor regulatory inspection. Or maybe your Audit Department has identified weaknesses in a critical area.

Our consultants can shine a light and show you the way…

Courses

Do you need world-class training that’s ready to go?

We have set courses on key topics and expert trainers that ready to go at a moment’s notice.

Anywhere in the world.

Or, you prefer, remotely comfort of your own desk…

Lessons Learned Clients

“We called on Lessons Learned to help us with customer due diligence, an important issue that is fundamental to all financial organisations. We were delighted with what we can only call an engaging programme, which not only educated our workforce, but actually gave us working knowledge about the issues. Using animation, video, games, and detailed case studies, what was covered will certainly help us enormously going forward.”

Sajeevani Wijayawardena

Training Manager - Banking Operations & Systems

Emirates NBD

“ The video had the desired effect, as in total attention throughout, the odd nervous laugh and, finally, stunned silence.”

Anti-Corruption Director

Global Pharmaceutical Company

‘We have found Lessons Learned’s programmes to be extremely useful as a tool for raising awareness and engaging our staff ... excellent content, highly recommended.”

Chief MLRO International Bank

Sajeevani Wijayawardena

Training Manager - Banking Operations & Systems

Emirates NBD

“We called on Lessons Learned to help us with customer due diligence, an important issue that is fundamental to all financial organisations. We were delighted with what we can only call an engaging programme, which not only educated our workforce, but actually gave us working knowledge about the issues. Using animation, video, games, and detailed case studies, what was covered will certainly help us enormously going forward.”

Anti-Corruption Director

Global Pharmaceutical Company

“ The video had the desired effect, as in total attention throughout, the odd nervous laugh and, finally, stunned silence.”

Chief MLRO International Bank

‘We have found Lessons Learned’s programmes to be extremely useful as a tool for raising awareness and engaging our staff ... excellent content, highly recommended.”

Lessons Learned News

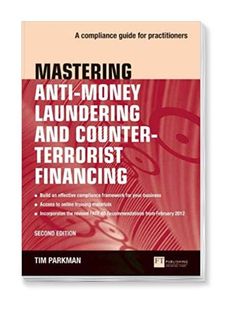

Mastering Anti-Money Laundering

Mastering Anti-Money Laundering and Counter-Terrorist Financing, by our Principal, Tim Parkman, helps financial institutions put together an effective framework to ensure that they meet their legal obligations.

Global KYC Capacity Development Programme

Following success in a competitive bidding process, in 2025 and 2026 Lessons Learned Ltd is delivering a KYC enhancement programme internationally on behalf of the Dutch Good Growth Fund.

Role‑Based AML Training for UAE Professionals

Our new UAE role‑based AML training guide equips financial professionals with practical compliance tools, tailored scenarios, and sector‑specific insights to strengthen integrity frameworks.

Conflicts of Interest and Codes of Conduct

Lessons Learned has a long association with a number of major multilateral banks in Europe and The Americas and in 2025 continues its delivery of staff integrity related programmes such as Personal Conflicts of Interest.

Lessons Learned Blogs

Make an Enquiry

Get in touch with us to discuss your compliance needs.

Our Location

Lessons Learned Ltd, 55 Anchor Brewhouse, Shad Thames, London SE1 2LY

Contact Us

info@lessonslearned.co.uk

Submit Inquiry

Please try again later.

Contact Our Experts

Frequently Asked Questions

We understand that navigating financial crime compliance and business ethics can raise many questions. Below, we address some of the most common inquiries to provide clarity and transparency about our services.

What types of organisations do you work with?

Lessons Learned collaborates with a diverse range of clients, including corporations, non-governmental organisations (NGOs), and public sector entities. Our tailored solutions are designed to meet the unique needs of each organisation, regardless of size or industry.

How can your training programs benefit my team?

Our training programs are designed to empower your team with the knowledge and skills necessary to navigate compliance challenges effectively. By focusing on real-world scenarios and best practices, we enhance decision-making and foster a culture of integrity within your organisation.

What is your approach to compliance assessments?

How do you ensure the effectiveness of your workshops and training?

We utilise a variety of interactive methods, including case studies, role-play, and e-learning modules, to engage participants and reinforce learning. Feedback from attendees is also collected to continuously improve our offerings and ensure they meet the evolving needs of our clients.

Ready to Elevate Your Compliance Strategy?